Welcome to the second in a series of four posts designed to help your coaching clients make it through the last surge of the Coronavirus pandemic. In today’s post, we’ll explore how to help your clients develop a cash gap plan to help them stay cashflow positive.

In our first post in this series, we explored the trajectory of the Coronavirus pandemic and why it’s important to help your coaching clients get through the winter.

Today, we’re going to dive into a problem that many businesses struggle with—one that can prove particularly deadly during lean economic times:

Negative cash flow.

You’ve heard the saying, Cash flow is king. That’s because poor cash management can put even profitable enterprises out of business. This is especially true of the small to medium sized businesses you’re coaching, because they tend to lack reliable, affordable access to capital.

During periods of temporary economic decline, which seem likely over the next few months until Coronavirus vaccines become widely available, cashflow problems can be especially deadly.

Therefore, one of the most important strategies you can help your clients implement is a cash gap plan.

One of the most important strategies you can help your clients implement is a cash gap plan.

What’s a Cash Gap Plan?

In a nutshell, a cash gap plan is an efficient plan to quickly collect your outstanding receivables, get your customers to pay faster, and negotiate better terms with your vendors so your bank account always has plenty of cash in it.

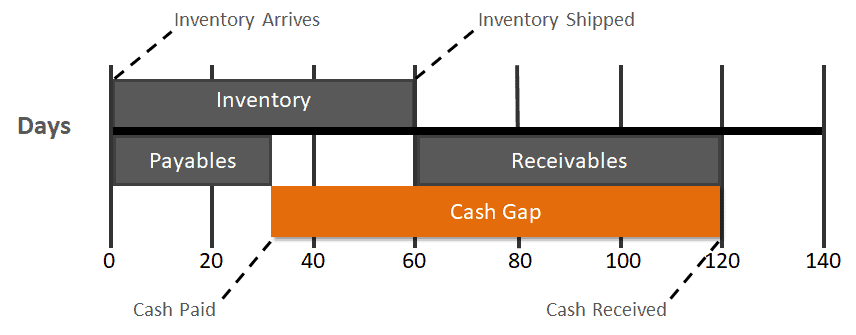

Here’s an chart to help you understand what I mean:

Many businesses operate with a gap between when their expenses are due, their inventory ships, and they receive payment.

The larger this gap is, the more at risk the business will be.

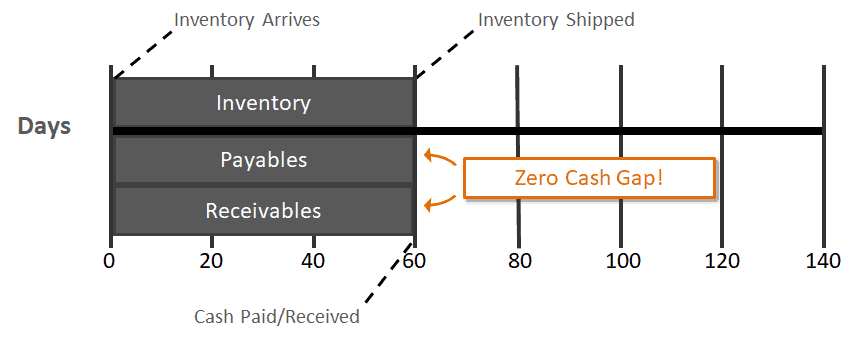

The objective of a cash gap plan is to help your clients align their timelines such that cash is paid and received simultaneously.

There are three basic ways you can help your clients eliminate their cash gaps.

Accounts Receivable

The first is to help clients tighten up terms with their customers. This can be done in a variety of ways:

- Encourage pre-orders

- Negotiate shorter terms with new customers

- Incentivize faster or upfront payment with premiums and discounts

- Implement an automated collection system, including letters, calls, and bonuses for AR staff

- Outsource collections to a factoring company

Accounts Payable

Second, help your clients extend terms with their vendors. Encourage them to do a thorough review of their vendors and terms in order to determine which would pack the greatest punch. Then, have them research alternative vendors to which they could switch if necessary.

Work with your clients to reach out to their vendors based on the prioritization they’ve identified in order to renegotiate terms, using the alternative vendors as both a negotiation point and a back-up if negotiations prove fruitless.

Inventory

Finally, encourage your clients to adopt a lean mindset that eliminates wasted time, material, movement, and inventory in order to improve operational efficiencies, cut production, and compete more effectively. This means identifying areas of waste and excess in inventory and elsewhere throughout the business.

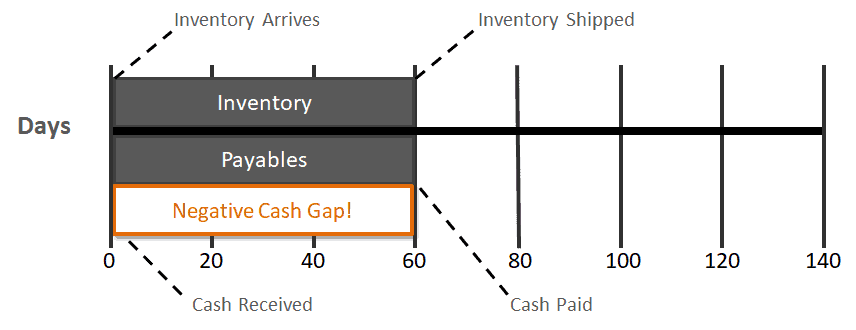

If you do this correctly, not only will your clients be able to eliminate their cash gap, they’ll even be able to create a negative cash gap—that is, where cash comes in before it goes out.

This is a sign of a healthy, thriving business—one that can certainly survive not only the Coronavirus winter, but well into the future.

Other posts in this series:

Want to dive deep into how to help your clients get a handle on their cashflow? Learn exactly how to coach your clients through this process, complete with white label training and in-depth cash analysis tools, by getting a FREE 30-day trial of our comprehensive business coaching system.